Life Settlement Valuation Overview

The industry standard policy valuation approach is called the probabilistic method (as opposed to

deterministic or stochastic).

The term probabilistic refers to

the survivorship curve (probabilities of survival) with which future cash flows

are weighted.

present value as opposed to an accountant’s present value which would discount

the cash flows with interest only. We’re including a measure of the likelihood that the insured survives to each future

year of age.

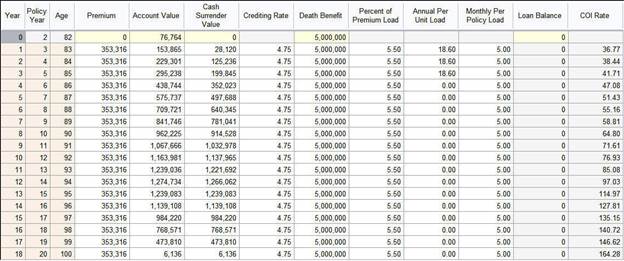

Step 1 - Reverse Engineer COI Rates

COI rates can be calculated from a standard Policy Illustration. Most

illustrations contain enough information that the COI rates can be determined.

It is important that any valuation model accommodate most common UL policy features

so that the COI rates may be calculated with the greatest possible accuracy:

- Death Benefit Options

- Level

- Increasing

- Return of Premium

- Extended Death

Benefit

- Required

Annual Premium

- Policy Loads

and Fees

It is not likely that any model

will be able to properly value policies with secondary guarantee provisions

since the details of the UL fund accumulation are disclosed by the carrier.

These contracts can often be analyzed as non-UL contracts (Premium and Death

Benefit Only), so any valuation model should support non-UL product types in

addition to UL products.

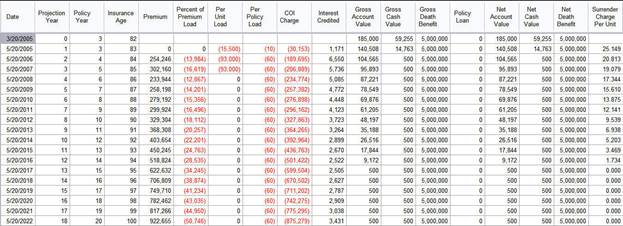

Step 2 - Project Optimum Premium

After obtaining the COI rates, future projected premiums may be calculated. The

goal is to determine the minimum (optimal) funding premium which keeps the contract

inforce without overfunding the contract.

Some desirable features of a valuation model include:

- There should be some facility to

roll the account value forward from the date of the last known account value to

the projection start date. Without this, it will be necessary to obtain the policy

account value as of the projection start date either from an external calculation,

or by contacting the carrier

(impractical).

- The model should provide various

threshold options so that the analyst can dial in the level of future premium

paid based on the amount of target account value is desired in each future year

of the contract.

- Similarly, the analyst should be able to specify various patterns of future

premium payments – monthly, quarterly, etc. It is also desirable to be able to

input a custom stream of premium payments for the first few years before allowing

the model to optimize the remaining premiums (more control over the analysis).

Step 3 - Develop Survivorship Curve

Most of the variability in pricing results from the sensitivity of the analysis

to changes in mortality (expected longevity). It is critical when analyzing a single

case to perform sensitivity testing – i.e., to be able to stress the survivorship curve

to generate a range of possible outcomes.

Important features of a valuation model include:

- Ability to model multiple LE

estimates in one run.

- Ability to apply mortality

improvement and to otherwise reshape the mortality curve by applying adjustment

factors by age and duration.

It is increasingly important to

be able to work directly with the vector of lives supplied by some LE

underwriters as part of their LE report since this vector effectively provides

the analyst with the mortality table used by the underwriter and sometimes

significantly affects the analysis.

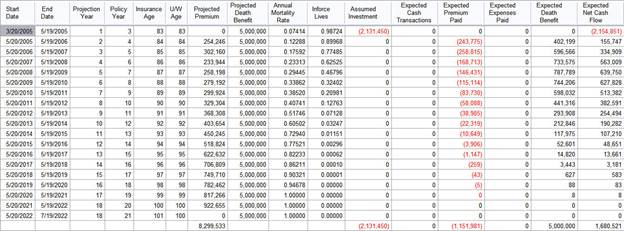

Step 4 - Calculate Valuation

Important features of a valuation model include:

- The model should generate a range

of values based on various Life Expectancy estimates and assumed discount

rates.

- Should be able to model the

organization’s expense structure if appropriate.

- The model should produce a complete

set of valuation cash flows – expected premium, death benefits and expected

survivorship curve.

Portfolio Considerations

Stochastic analysis is necessary to

assess the range of possible portfolio outcomes.

Critical to anyone investing in a

portfolio of life settlement contracts.

Valuation model should integrate well with portfolio analytics. At a

minimum, it should be possible to pass optimized premium, death benefit and

survivorship vectors to the portfolio tool from the valuation model.

Other descriptive fields such as Carrier, Diagnosis, State of Issue, etc.

are also of interest to assess concentration of risk in the portfolio.

A record of actual purchase price and premiums paid is necessary to calculate

portfolio IRR’s. Model should be able to incorporate known payments with future

projected payments to arrive at projected IRR.